Small Business Resources to Overcome COVID-19

Contents

We are providing helpful information for small businesses and marketing professionals to better navigate the changing landscape caused by COVID-19 as it relates to marketing, nonprofits, and small business.

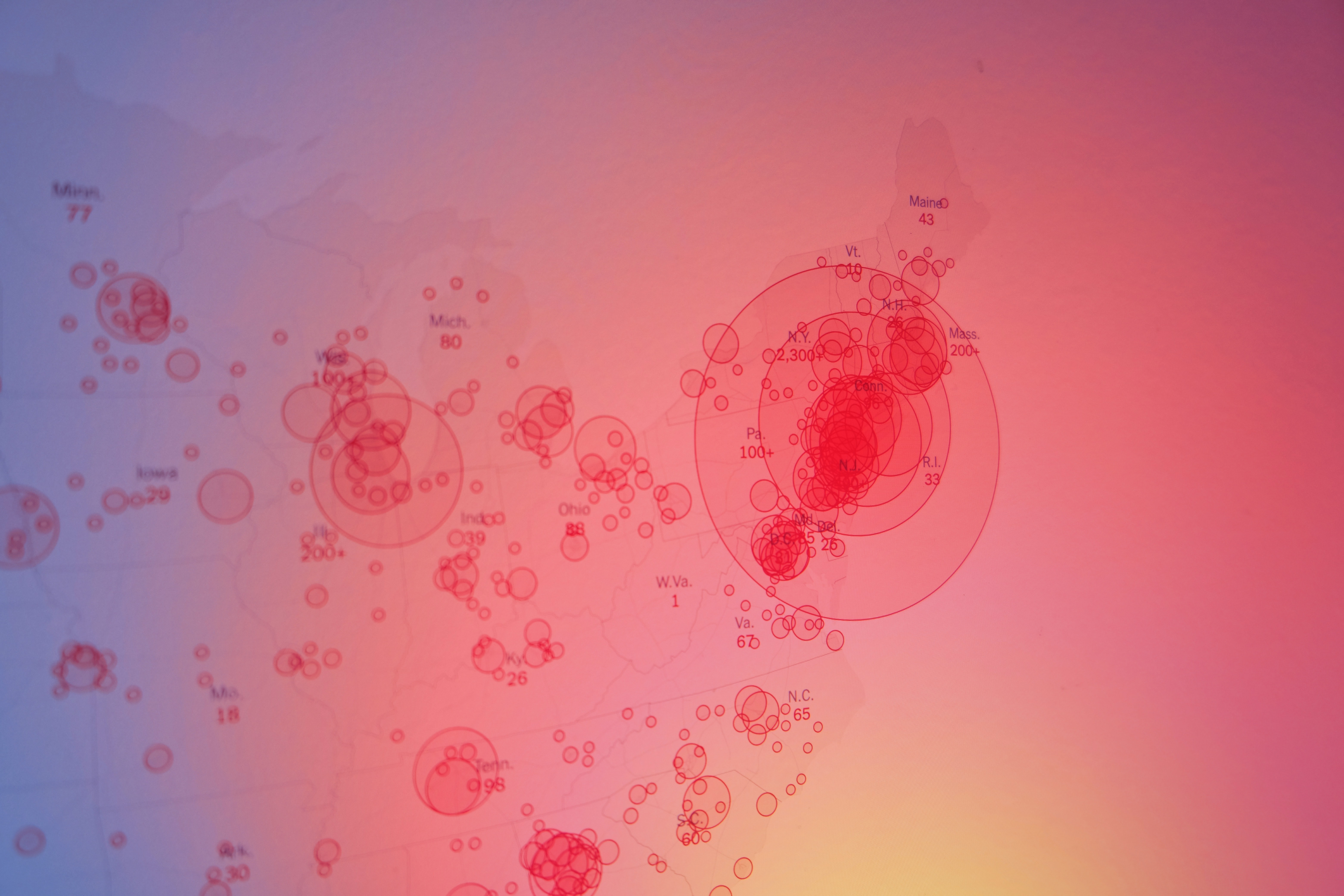

Photo by Brian McGowan on Unsplash

It appears that in the US, the COVID-19 is still rampant and continuing to change lives more than anyone could have imagined even a month ago. Plus, the uncertainty that’s looming around how our lives and businesses will be affected due to the aftermath that the coronavirus pandemic will leave can at times be overwhelming to try to take in. So as one small business to another, we are trying to give back by providing useful resources to help you navigate this difficult and uncertain time.

Today I'm bringing you several resource lists to help your small business get support to navigate the months to come. And next week, I'll have more information specifically related to help for nonprofits.

Advertising Resource

Anytime companies tend to become cash-strapped or there's an environment of economic uncertainty advertising and marketing budgets are the first to get slashed. But that strategy is very short-sighted. If you're in it for the long hall, you really should be trying to incorporate increased advertising spend during the recession. And if you do, you will be rewarded on the other side.

“Those companies that maintained or increased their advertising during a recession saw a 275% increase in sales growth during and for the three years following the recession. Companies that had cut back or stopped advertising experienced only a 19% increase.”

McGraw-Hill Research. Laboratory of Advertising Performance Report 5262, New York: McGraw-Hill, 1986

So to help you keep a hold on cash flow while ramping up your advertising budget here are a couple advertising resources that both Google and Facebook are offering its customers because of the coronavirus pandemic.

Google Is Offering $340 Million in Google Ads Credits

To help SMBs navigate the challenges COVID-19 is causing, Google is pledging $800+ million to support small businesses and crisis response. $340 million of that support is in the form of Google Ads Credits. If you had an active account since the beginning of 2019 you will see a credit notification appear in their Google Ads account in the coming months. And the credit you receive can be used at any point until the end of 2020.

Do I qualify?

Currently, the specifics are vague. But it appears that the qualifications are if you had an active account in 2019. Here is a link directly related to these ad credits that will hopefully be updated with any specifics along the way.

How it works?

At this time, it appears that this will be automated. For our clients, we will be getting in touch with our Google representative to make sure that they receive the full benefit of this initiative.

Facebook Is Offering $100M in Cash Grants and Ad Credits

Another resource for small businesses in advertising funds is the $100 million pledged by Facebook to be offered up as cash grants and ad credits for businesses experiencing disruptions in the 30 countries where Facebook operates. It appears that this offer will be more application based.

Do I qualify?

The specifics have not been posted yet. Here is a Facebook resource to sign up and receive update as they're available

How it works?

The specifics have not been posted yet. Here is a Facebook resource to sign up and receive update as they're available

Marketing and Business Tools Offering COVID-19 Related Help

- Convertkit is offering active creator assistance in four categories of funds needed for medical expenses, groceries, childcare, and rent/mortgage.

- GoDaddy is offering 3 months free of their email marketing tool and one month free premium subscription.

- HubSpot offering free tools to help businesses expand their online operation, removing marketing limits and increasing calling minutes for 90 days, and reducing the cost for Starter Growth Suite to $50.

- Image in a Box is offering free strategy sessions to safely discuss your small business hardships and brainstorm actionable marketing and business steps to take to help your small business come out stronger on the other side of this.

- Mailchimp is offering up to 4 months free and support for customers who are thinking about pausing or canceling their accounts through exclusive partners (we are an exclusive partner so contact us for help).

- Microsoft and GoDaddy are partnering to offer MS Teams free for 6 months.

- MOZ is offering MOZ Academy for free.

- Nstore is a free online ordering and curbside pickup tool that we, Image in a Box, just launched for restaurant owners to quickly set up online ordering and curbside pickup free of charge.

Small Business U.S. Government Loans

There has been a lot of small business initiatives coming out. There were multiple options prior to the passing of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. And now they're even more coming with CARES. Here are a few of the active options for government support for your small business during this time.

If you need any help figuring out which option is best for you be sure to talk to your accountant and banker. And if you are lacking in both areas and you’re located in North Alabama, feel free to message us through any social media channel or our contact page and we can put you in contact with someone locally that can help you.

Bank Offerings and Other Lending Resources for COVID-19

- BBVA Bank is deferring loan payments, waving ATM fees, offering penalty free CD withdrawals, and refunding overdraft fees until April 17th.

- BB&T (now Truist) is providing temporary relief assistance to loan clients and temporarily waving ATM fees. Plus, they have additional loan options.

- Cadence Bank is offering deferred loan payments and has helpful information about the SBA loans we mentioned above.

- First Bank is offering debt relief to loan customers, extensions on payments, they encourage customers to contact their local branch or banker.

- Iberia Bank is offering special assistance through April 30th. Check their site for more details.

- Neighborhood Concepts, a local nonprofit organization, is offering loans to small businesses that don’t have a high enough credit rating to apply for the SBA loans.

- PNC Bank is postponing loan payments for up to 90 days w/ no late fees, including consumer, line of credits, auto, mortgage. Student loan deferrals are also available, and a modification option is available. They have temporarily suspended foreclosure proceedings and eviction activities. Information also posted about SBA loan. Hardship Form

- Wells Fargo is offering assistance to small businesses through the Wells Fargo Foundation. “Resources will be deployed to meet the urgent needs of small businesses, $2 million of which will focus on the deployment of flexible capital in collaboration with Opportunity Fund and will also provide immediate cash boosts and financial coaching support of entrepreneurs and their low-wage workers in coordination with SaverLife.”

I hope that this article has been helpful for you. If you know of any other great resources for small business owners, feel free to DM Image in a Box on Instagram.